Key takeaways

Dollar cost averaging is the process of purchasing an investment on a regular schedule. An example is a 401(k), where an employee contributes the same amount each month.

There isn’t a financial advantage to a dollar cost averaging strategy, apart from the regularity of investing.

Instead, it brings psychological benefits and helps investors ride the ups and downs of the market without as much stress.

Investing a lump sum of cash into a volatile market can be challenging for first-time

and seasoned investors alike. No one wants to see the balance on their accounts decline. One strategy that can help balance out the volatility is dollar cost averaging (or DCA investing), and it can provide benefits to any type of investor.

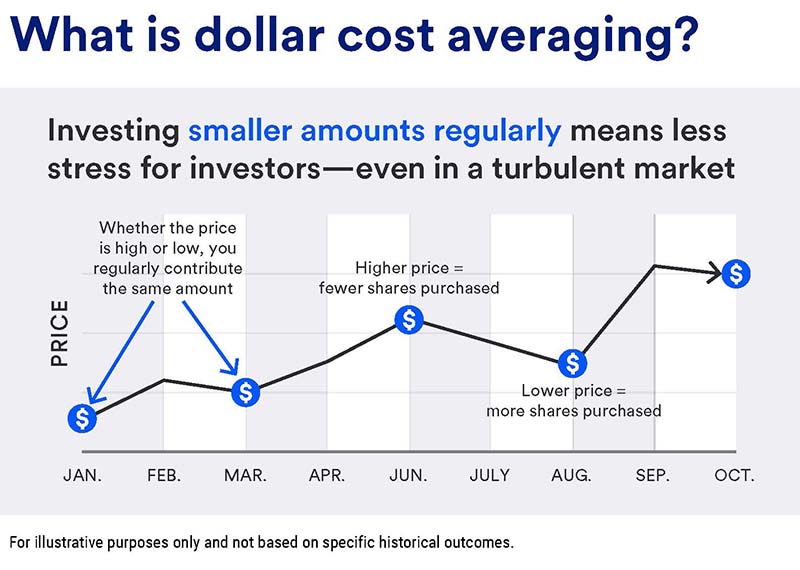

Dollar cost averaging is an investment strategy in which you purchase investments on a regular schedule, regardless of market conditions. This approach minimizes the impact of market volatility on your portfolio and helps you avoid the risk of putting a large amount of money into the market all at once.

How does dollar cost averaging work?

Dollar cost averaging works by investing in consistent intervals instead of investing a lump sum. This allows you to buy more shares when prices are low and fewer shares when prices are high, effectively averaging out your investment cost.

The amount of money invested using this approach is usually smaller than a lump sum would be, but the contributions will build up steadily over time. The smaller, regular contributions also reduce the emotional impact of market fluctuations.

Consider this dollar cost averaging example: Let’s say you want to invest $1,200 in a particular stock. Using a dollar cost averaging strategy, you would invest $100 each month over 12 months.

- In month one, the stock price is $10 per share. Your $100 would buy 10 shares.

- In month two, the stock price increases to $20. Your $100 would buy five shares.

- In month three, the stock price drops back to $10. Your $100 would buy 10 shares.

Over the course of 12 months, you would purchase more shares when prices are lower, averaging out the per-share cost while potentially reducing your overall risk. This eliminates the stress of trying to time the market perfectly.

How to start dollar cost averaging

One of the most common dollar cost averaging scenarios is when an employee signs up for an employer-sponsored retirement plan, such as a 401(k).

Someone making $150,000 per year who is paid twice a month would receive gross pay of $6,250 per pay period. If they allocated 10% of their pay to a 401(k), they would be saving $625 out of each paycheck. At the end of the year, they would have saved $15,000. The return on the funds inside of their 401(k) would fluctuate based on the market.

Dollar cost averaging allows you to buy more shares when prices are low and fewer shares when prices are high, effectively averaging out your investment cost.

Benefits of dollar cost averaging

Interestingly, research has found that there isn’t a significant financial benefit of dollar cost averaging, such as earning an extra return, when compared to a lump sum investment. The biggest advantages to a dollar cost averaging strategy are the psychological benefits it can provide.

Dollar cost averaging helps you feel comfortable with uncertainty.

As prices in the market rise and fall, the value of stocks and bonds change, too. If you're putting a regular amount to work in the market over time without regard to price, you’ll essentially continue to accumulate investments.

DCA investing makes “timing the market” obsolete.

Dollar cost averaging takes a patient approach. It removes the desire to try to time the investment, since there is no way to know the best day to buy. It can also remove the regret you may experience if you don’t time the purchase of the stocks or bonds just right.

Dollar cost averaging takes the emotion out of investing.

Since DCA relies on consistency, investment decisions are not based on emotions or reactions to current market trends. Even in a market peak, regular contributions allow you to benefit over time.

DCA investing removes decision fatigue.

With dollar cost averaging, you don’t have to determine how many shares to purchase based on price. It takes away the discipline needed to make regular investments since it creates an investment habit that’s predetermined and automatic.

Disadvantages of dollar cost averaging

While dollar cost averaging has its benefits, it’s not without its drawbacks. If you’re considering this investing approach, keep the following in mind:

You may forfeit returns.

By holding some of your money in cash as you slowly invest, you may miss out on potential gains if the market moves upwards. This may lead to lower returns compared to lump sum investing over longer timeframes.

Dollar cost averaging may not be ideal for all situations.

For workplace investments like 401(k) plans, DCA naturally aligns with income flow. However, if you have excess funds available now, lump sum investing may be more advantageous.

Potential for brokerage fees.

Frequent investments could result in higher brokerage fees, particularly for platforms that charge per trade. These costs can slowly eat into overall gains.

Is a dollar cost averaging strategy right for you?

Dollar cost averaging can offer a variety of benefits, but there may be times when investing a lump sum into the market is the better choice. It’s important to work with a financial professional to determine the best tools and strategies for meeting your financial goals.

They can help you evaluate your goals, cash flow needs, and long-term plans to tailor a strategy that works for you.

Remember, time in the market often matters more than trying to time the market. Steadily investing through ups and downs builds both financial and emotional resilience as you work toward your goals.

From investing online to working with a financial professional, learn more about your investing options.

Tags:

Explore more

Should I buy-and-hold stocks for long-term investing?

Instead of trying to time the market, consider buying stocks and other securities and holding on to them regardless of changes in the market. Read more about the benefits of this long-term investment strategy.

Personalized investing guidance aligned with your goals.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.