Promo code Q3PRO25 MUST be used when opening a U.S. Bank Business Essentials®, or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

Bonus Options

- Earn your $400 Business Checking bonus by opening a new U.S. Bank Business Essentials account between 7/01/2025 and 9/30/2025. You must make deposit(s) of at least $5,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $5,000 until the 60th day after account opening. You must also complete 5 qualifying transactions within 60 days of account opening.

or

- Earn your $1,000 Business Checking bonus by opening a new U.S. Bank Platinum Business Checking account between 7/01/2025 and 9/30/2025. You must make deposit(s) of at least $25,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $25,000 until the 60th day after account opening. You must also complete 5 qualifying transactions within 60 days of account opening.

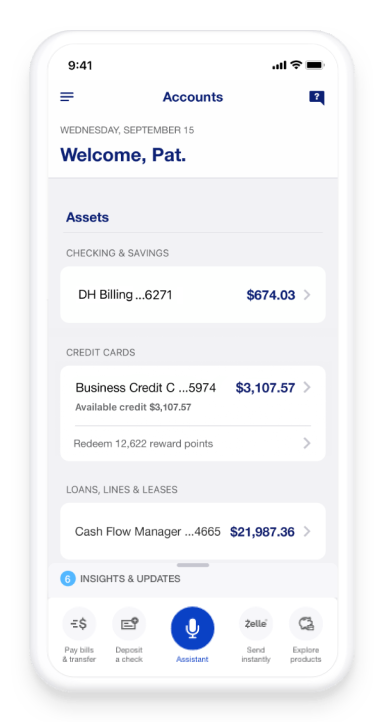

Qualifying transactions include debit card purchases, ACH credits, Wire Transfer credits and debits, Zelle credits and debits, U.S. Bank Mobile Check Deposit or Bill Pay. Other transactions such as (but not limited to) other Person to Person payments, transfers to credit card or transfers between U.S. Bank accounts are not eligible.

New money is considered money that is new to U.S. Bank. Funds must come from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees (e.g., monthly maintenance, paper statement fee, etc.) could reduce the qualifying daily balance, therefore you must make deposit(s) to cover the fees to maintain the daily balance during the qualifying period to be awarded the bonus. Refer to the Business Pricing Information or Business Essentials Pricing Information Document for a list of fees.

Bonus will be deposited into your new eligible U.S. Bank Business Checking account within 30 days following the last calendar day of the month you complete all of the offer requirements, as long as the account is open and has a positive available balance.

Offer may not be combined with any other business checking account bonus offers. Existing customers (businesses) with a business checking account or customers (businesses) who had an account in the last 12 months, do not qualify.

All regular account-opening procedures apply. For a comprehensive list of checking account pricing, terms and policies, reference your Business Pricing Information or Business Essentials Pricing Information and YDAA disclosure. These documents can be obtained by contacting a U.S. Bank branch or calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice.