If you’re new to the homebuying process it can be hard to know where to start. What kind of income do you really need to qualify for a mortgage? What are the steps involved? How do you separate fact from fiction? We’re here to help dispel some mortgage myths and set you up for success.

Look beyond the interest rate

Contrary to what you might believe, your mortgage interest rate may not be the most important factor. There are plenty of numbers that go into your monthly mortgage amount and an interest rate is only one piece of the puzzle. Depending on the price of the house a small difference in mortgage interest rates could be manageable. For a home priced at $350k, for instance, you could be looking at a payment difference of $12 to $25 per month for every .125% increase in the interest rate. But note that these amounts do add up over the life of the loan.

Two other crucial factors are the size of the loan you plan to take out and how quickly you want to pay it off. Your costs will be greater the less money you put towards a down payment and the longer your loan term. Other factors that can impact your monthly mortgage payment include private mortgage insurance, property taxes, homeowner’s insurance and association fees.

Save for your down payment right away

It’s true that the down payment can be one of the biggest hurdles aspiring homeowners face. It can be an even bigger hurdle if you work in a job that doesn’t have a consistent pay schedule. This is why you want to start saving as soon as possible.

Start saving what you can each month. For example, if you deposit $250 each month for twelve months into a savings account you will have saved up to $3,000 for a future down payment. Or deposit the difference between your current housing expense and your ideal future monthly mortgage payment. That way you can start building the cushion you need while getting used to the monthly expense.

Most lenders want to know that you’ve got a steady income when considering whether to approve you for a mortgage. But what if you have the kind of job where your income ebbs and flows from month to month? You’re not alone, lots of people are in this category including gig workers, small business owners, contract workers and people who do seasonal work. Don’t worry, buying a home can still be in reach for you. One strategy is to save for a larger down payment which can help you during the approval process. You might also build your savings or have additional income sources as a backup plan in case your income from your primary work drops unexpectedly.

Now that you know the basics, it’s time to put your plan into action.

7 steps to buying a house for the first time

From the spark of an idea to the moment you turn the key to your new home, here’s how to go about getting a mortgage:

- Pre-qualification: This is a good starting point to get a general idea of what size mortgage you can get. It’s especially helpful for people who are just browsing. To get pre-qualified you meet with a mortgage loan officer and share your income, but you’re not gathering documents at this point. In fact, you can prequalify online.

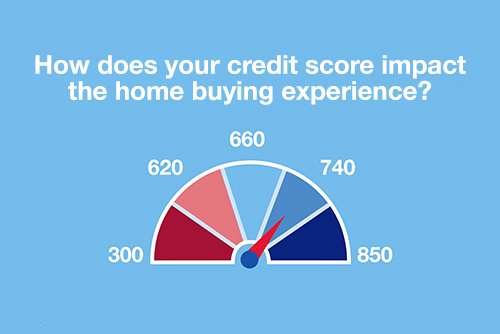

- Pre-approval: This step takes a deeper look into your financial history than pre-qualification. Depending on your lender, you may be asked to provide documentation of your salary, assets and debts, as well as a credit check. This is the time to understand your credit score and to look at how much debt you currently hold. Depending on your situation, you may need to have a co-signer who has a steady income and good credit history. At the end you’ll have a letter from a lender saying you’re likely to get a specific mortgage, and that can make a big difference to a home seller. (Note: Pre-approval is neither an obligation to buy nor to lend.)

- House hunting: Resist the urge to shop for homes until you know how much of a loan you qualify for. Once you do have your loan amount, go ahead and start shopping.

- Document gathering: Once you’ve decided on a home and made an offer, your mortgage lender will ask you to show your income and provide other documents to support your loan application. Also, you may be asked to pay for an appraisal, which is something the lender schedules to confirm the home’s value aligns with the purchase price.

- Processing and underwriting: Once you’ve applied for the loan, an underwriter evaluates your application. They look at the appraisal and check to see if there are any liens on the property which is called a title search. They also look at your employment, income, credit, assets and where your down payment will come from. While this is happening be careful not to take on any new debt or to make other financial changes that could impact your loan request. If you get conditional approval, the underwriter might request a few more documents.

- Final approval: Once your loan is approved, you’ll be ready to close. You will be given an estimate of the closing costs shortly after you submit your loan application and then just before closing you will receive a Closing Disclosure, or CD, with the terms of the agreement and your final costs.

- Close and sign: When it comes to the homebuying process, closing day is the big finale – the day the house officially becomes yours. At the closing, bring your photo ID and a cashier’s check for the down payment or arrange for a wire transfer. After signing several documents, you will be handed your new keys!

Make your mortgage loan officer your ally

Don’t think you have to figure this all out on your own, either. Your mortgage loan officer can be your guide throughout the entire process, giving you options for real estate agents, builders, home inspectors and homeowner’s insurance agents.

Be sure to take full advantage of their experience. They can let you know which loans to consider, how to structure them and how much of a down payment you'll need. Above all else, don’t rule out a house you might want to buy before consulting with your mortgage loan officer.

If you’re ready to learn more about mortgages, we're here to help. Reach out to a mortgage loan officer to discuss your situation over the phone, via email or within a branch.