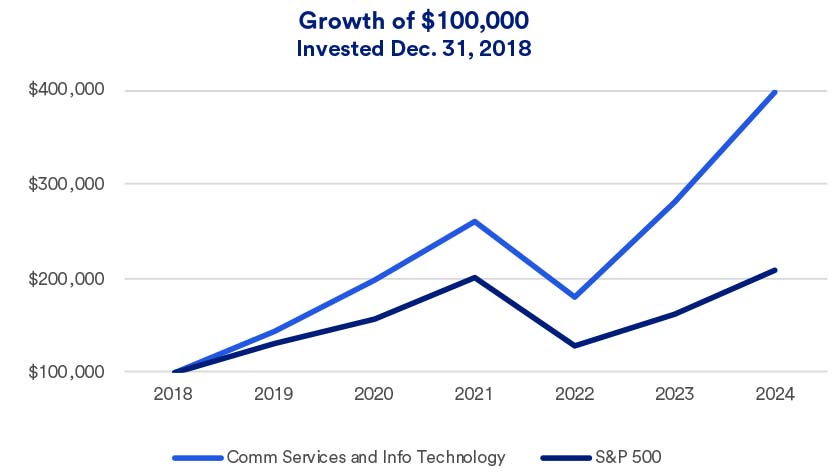

“The key question is whether current lofty valuations for some tech stocks can be sustained by real revenue growth,” says Haworth. He notes that AI is likely to play a critical role in boosting productivity, helping overcome labor shortages in select industries. “Investors still see upside potential for technology stocks because much of their price growth is supported by actual earnings. It’s not just speculation that the future is going to be increasingly profitable,” says Haworth. “Today’s environment is in contrast to previous historical periods where price bubbles developed, unsupported by underlying earnings.”

The future of technology stocks

Although the technology sector is always subject to short-term volatility, Sandven remains optimistic about the sector’s long-term potential. “Companies are looking to get bigger, faster and stronger. They’re not doing that through hiring more people. They’re doing that through technology spending.”

Haworth also remains optimistic about technology stocks’ direction. “Technology stocks remain important to the market, especially for the long term,” says Haworth. “In today’s environment, technology stocks benefit the most from business capital spending and are at the core of our current economic expansion.” Nevertheless, he notes that investors need to be selective in their approach to this sector. While some technology startups achieve tremendous success, many firms fail to get off the ground.

As you assess the most effective ways to position your portfolio consistent with your goals and time horizon, be sure to consult with your financial professional.

The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. It is an unmanaged index and direct investment in the index is not possible.