Apply for a checking account online in less than 5 minutes.

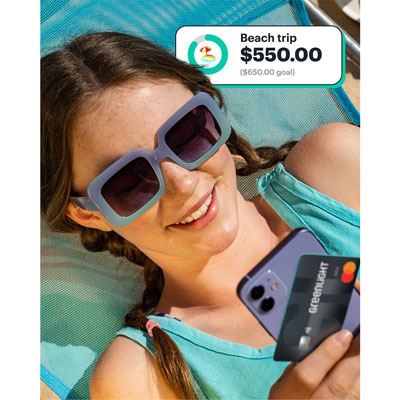

A debit card for kids and teens

With the Greenlight debit card and the Greenlight app, kids gain valuable real-life experience managing their own money. They can:

- Save and spend wisely with flexible parental controls.

- Manage chores and get paid for their hard work.

- Learn important financial basics with interactive games and video

- Earn 2% rewards on savings2

Kids can even personalize their Greenlight card with a photo or artwork for a fee.3

Teach the value of earning

Create chore lists for your kids in the Greenlight app. You can tie chores to allowance and pay it weekly, biweekly, or monthly.

It’s a debit card for kids, but you’re in charge.

The Greenlight app is loaded with features to help you stay fully involved in your kids’ financial lives. You can also monitor their Greenlight balances and recent transactions in the U.S. Bank Mobile App.

Transfer money to their cards instantly.

Send money instantly and monitor your kids' spending from the U.S. Bank Mobile App.

Stay in control.

Decide exactly where and how much your kids can spend—even set ATM withdrawal limits.4

Get real-time notifications.

Stay aware with alerts whenever they make a purchase with Greenlight.

Turn Greenlight cards on and off.

If a their debit card is lost or stolen, freeze it anytime for peace of mind.

Track transactions and balances.

Review and discuss their transaction history together.

Monitor transfers from others.

Friends and family can send money to your kids, too – but only with your OK.

Strive toward savings goals.

Saving is easier when kids have something to save for. Set specific targets in the Greenlight app and achieve them together.

Inspire lifelong financial confidence in the Greenlight app.

Greenlight Level Up™ is an in-app financial literacy game for kids with bite-size educational challenges and rewards that keep them coming back. With Level Up’s best-in-class curriculum, your kids can meet or exceed K-12 national standards for personal financial education – and have fun doing it.

It’s easy to get started.

Enjoy complimentary access to Greenlight with a Bank Smartly® Checking account.

There’s a $12 Monthly Maintenance Fee for Bank Smartly Checking which can be waived in multiple ways.5

Already have a checking account with us?

If you have a Bank Smartly® Checking account or any other eligible U.S. Bank checking account,1 you’re already eligible for a complimentary Greenlight account and debit card.

Got a Greenlight account, too? It’s super easy to connect your accounts to continue getting the benefits without the extra cost.

Frequently asked questions about Greenlight

Greenlight is the award-winning money app and debit card that empowers parents to raise financially smart kids. Kids and teens learn to earn, save, and spend wisely – while parents send instant money transfers, set flexible controls, and get real-time notifications. Greenlight has partnered with U.S. Bank to bring eligible checking clients a complimentary Greenlight account.

The Greenlight debit card benefit from U.S. Bank is available for kids and teens up to 17 years of age and their families. It’s complimentary for all of our clients who hold an eligible U.S. Bank checking account.1

With an eligible U.S. Bank checking account,1 your Greenlight account is complimentary. But if you enroll independently with Greenlight using an external checking account, yes.

Yes! You can enroll in Greenlight and get debit cards for up to 5 kids.

First, you’ll need an eligible U.S. Bank checking account.1 If you don’t have one yet, apply today for a U.S. Bank Smartly® Checking account. Once you’re approved, you can enroll in Greenlight from the U.S. Bank Mobile App or online banking. Need a visual? See how easy it is to enroll in Greenlight.

Yes. You’ll just need to update the funding source for your Greenlight account to a qualifying U.S. Bank checking account1 in the U.S. Bank Mobile App or online banking. To do so:

In online banking:

- Choose your U.S. Bank checking account from the account dashboard.

- Scroll down to the Activity section and choose the Account services tab.

- Select the Greenlight tile and follow the Connect to a Greenlight account link at the bottom of the page.

In the U.S. Bank Mobile App:

- Choose your checking account from the account dashboard.

- Select the Manage tab and scroll down to Account services.

- Choose Greenlight and follow the Connect to a Greenlight account link at the bottom of the screen.

The funds underlying your Greenlight Card Account are FDIC-insured up to $250,000 and your Greenlight Card comes with Mastercard’s Zero Liability Protection. Parents can block unsafe spending categories and Greenlight sends real-time transaction notifications, lets parents turn cards off at any time, and gives parents flexible ATM and spending controls.

It’s easy to load in the U.S. Bank Mobile App:

- Select your child’s Greenlight account on your account dashboard.

- Choose Send money on the account information screen.

- Select or enter the amount you wish to transfer to their card.

- Choose the U.S. Bank account you want to draw the money from.

- Hit Send.

That’s all there is to it. You’ll receive confirmation that the money has been transferred and you’ll see your child’s updated balance reflected on your account dashboard.

Note: While the funds will be available to your child right away, the balance in your checking account may not update for as long as 24 hours after the transfer.

Because the Greenlight card is a debit card, not a credit card, your kids can’t spend more money than they have. If they try, the transaction will simply be declined.

The Greenlight app gives parents lots of options, including:

- Flexible controls over how much their kids can spend and where (including ATM withdrawal limits)

- Full visibility to your kids’ transaction history

- Real-time alerts whenever your kids make a purchase with their Greenlight card.

- The ability to turn off (or “freeze”) a card when needed

- Parents can block specific spending categories.

- Greenlight also automatically blocks unsafe spending categories.

Of course. If the need arises for any reason, you can instantly freeze any Greenlight debit card using the Greenlight app.

Yes! Your child (or you) can add their Greenlight card to Apple Pay or Google Pay for tap-to-pay and online purchases.

No, Greenlight doesn’t support money movement with Zelle®. Instead, you can instantly fund your child’s Greenlight debit card via a transfer from your linked U.S. Bank checking account in the U.S. Bank Mobile App.