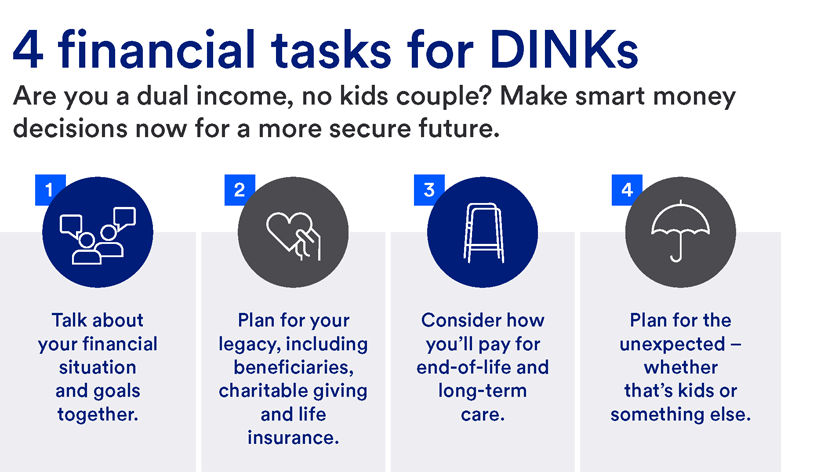

Every plan is unique and can accommodate your goals, income and assets. If you and your partner aren’t fully on the same page, a plan will provide guidelines for growing together, with space to pursue individual passions.

2. Not thinking about your legacy

Childfree couples should take the time to thoughtfully create and maintain their estate plans. This may include beneficiary planning, philanthropic opportunities, and life insurance. Houghton offers the following ways for couples to thoughtfully plan their legacy:

- Carefully consider beneficiaries. Those without biological heirs need to be more intentional about who will inherit assets. “Childfree couples should ask themselves: Who do I really want to benefit from my time, labor and accumulation of assets?” notes Houghton. These may be family members, friends or even charitable organizations.

- Understand your charitable giving opportunities. Gifting to charitable organizations is one way to leave the legacy you want. Childfree couples can also give through gift annuities or charitable trusts to clarify the gift while retaining an interest during their lives.

- Don’t leave out life insurance. Some people mistakenly think life insurance is only necessary if there are children involved, but it also ensures that there is income provided for one spouse if something happens to the other. “Life insurance is always an important consideration,” says Houghton, noting that even couples with significant wealth can use it for the payment of taxes.

3. Not preparing for long-term or end-of-life care

No one likes to think of end-of-life planning, but if you don’t have children who can step in as caregivers, any long-term care needs will have greater financial repercussions. Couples without children should ask themselves if they are financially prepared to deal with long-term illnesses or care costs that may arise at the end of their lives.

Houghton adds, “More importantly, I think they need to consider: ‘If I need care and outlive my partner, who is going to make the decisions and step in to make sure I am receiving the kind of care I’ve saved for?’”

Have open discussions with your partner about what those costs might include and ensure you’re saving enough — an HSA or a life insurance policy with a long-term care component can be great vehicles for this — to account for different potential scenarios.

4. Not planning for the unexpected

DINK couples need to prepare for unexpected family changes. So often, the modern family does not follow tradition. Some people become caretakers for a relative’s child later in life, or choose to care for their parents or even friends who have become like family. And some couples may add children later in life.

“Life throws unexpected expenses your way, with or without children,” says Houghton.

Houghton recommends that couples start their lives together with a financial plan that can provide a buffer for unexpected expenses or changes — whether that’s stepping up to the plate to support someone in need or having that unexpected, yet fantastic opportunity cross your path.

Financial planning for DINK couples: Prepare for a bright future

With a little forethought, all couples can put plans in place that will bring them peace of mind to enjoy the lives they’ve created for themselves.

“Whether you’re childfree or have five kids, setting a sound financial plan and being just a little bit conservative with it in the early years gives you more bandwidth for everything life brings to you,” says Houghton. “It’s never too early to begin the plan—and it’s never too early to get on the same page.”

Learn how our approach to wealth planning can help you work toward your financial needs today and in the future.