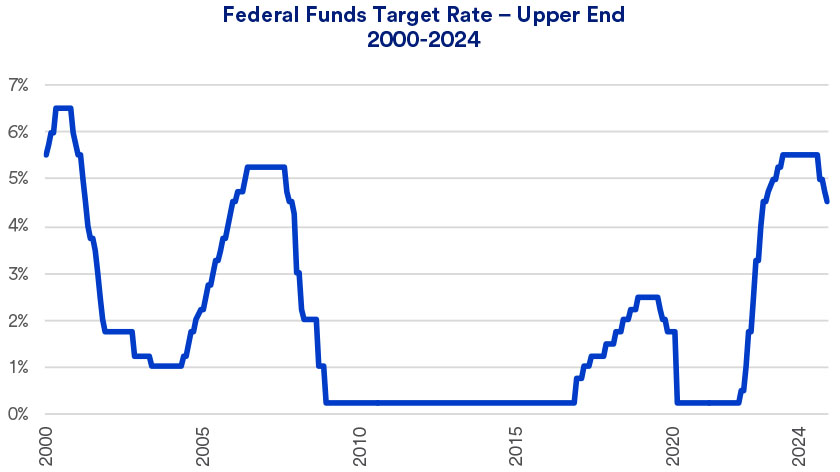

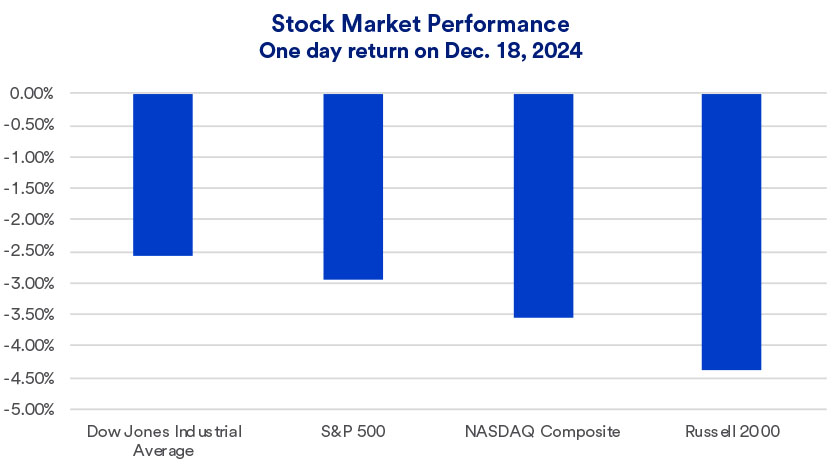

Notably, Fed officials, coming out of December’s meeting, appeared to scale back 2025 rate cut plans. The FOMC now projects just two 2025 rate cuts, compared to earlier projections of four rate cuts. “December’s Fed actions can be read as a hawkish cut,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “It sets the market up to be ready for the Fed to go into a pause rather than set the stage for immediate additional rate cuts.”

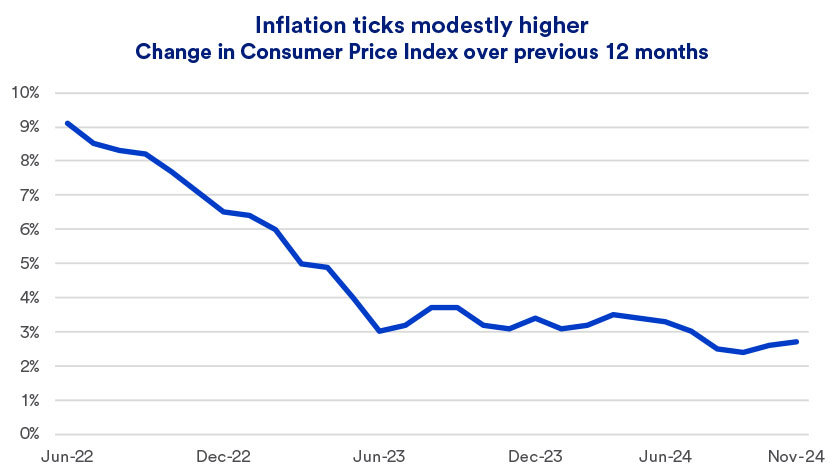

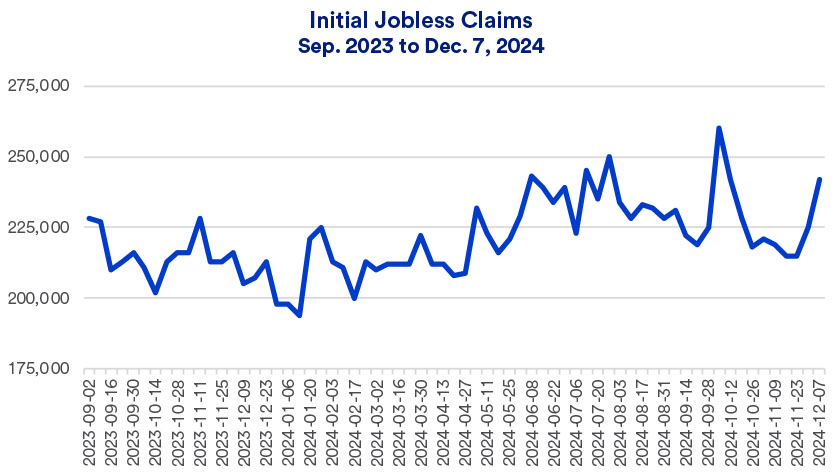

In a statement issued after December’s FOMC meeting, the Fed indicated that current economic data requires a policy balancing act. “Recent indicators suggest that economic activity has continued to expand at a solid pace (2.8% in 2024’s third quarter).1 Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low (4.2% in November 2024).2 Inflation has made progress…but remains somewhat elevated (Personal Consumption Expenditures at 2.5% in November 2024),”1 read the statement.3 In his own comments, Powell stated that given the Fed’s recently initiated rate cuts, “our policy stance is now significantly less restrictive. We can therefore be more cautious as we consider further adjustments to our policy rate.”4

Along with the latest interest rate cut, the Fed continues, as it has since 2022, reducing its balance sheet of fixed income assets. At its peak, the Fed’s balance sheet grew to nearly $9 trillion dollars. Each month, the Fed trims its Treasury bond holdings, which now have declined to approximately $6.9 trillion.5 “It seems unlikely the Fed will drop its balance sheet back to the $4 trillion level, as it stood in 2015-16, but given the extent the economy has grown since then, a larger Fed balance sheet may be justified,” says Haworth.

Economy projected to stay on course

After December 2024’s meeting, the FOMC issued its Summary of Economic Projections (SEP), reflecting each FOMC member’s forward view on key economic variables. The SEP suggests most major economic measures are expected to show little change in 2025.6