“We’re likely to hear numerous expenditure-cutting proposals,” says Haworth. “The market isn’t looking too hard at that, because it takes a lot to get anything substantial through Congress.”

While the recent funding extension maintained existing funding for all federal government departments into fiscal 2025, Congress also appropriated $100 billion in disaster relief related to recent hurricanes and in financial assistance to farmers.

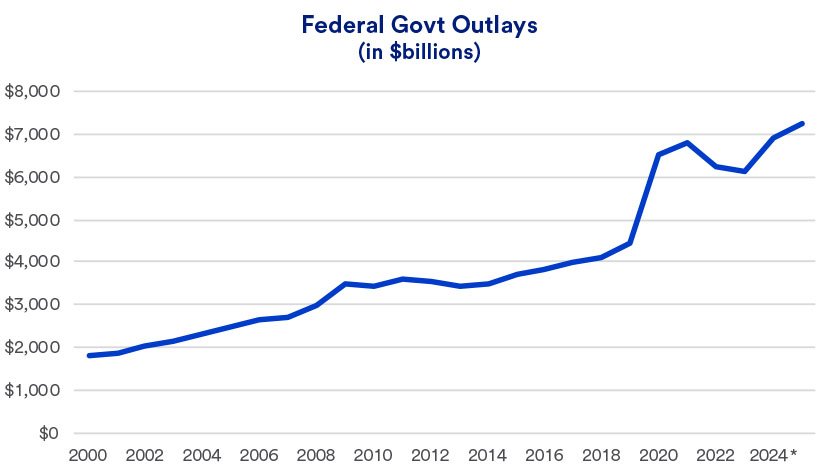

Congress also faces an estimated mid-2025 deadline to extend the federal government’s debt limit. The debt limit affects the U.S. Department of the Treasury’s ability to issue additional debt to finance government expenses. Debt issuance is required to fund deficit spending that exceeds current tax receipts. President-elect Trump urged Congress to dispense with its requirement to extend the debt ceiling going forward or to extend the current limit into 2027, but that provision was not included in the CR. It means that in 2025, the new Congress will need to again deal with the debt ceiling issue along with approving a final budget.

The next Congress convenes on January 3, 2025. President-elect Trump begins his second term on January 20, 2025.

A strained political environment

The political realities of the makeup of Congress add to budget process challenges, according to Kevin MacMillan, head of state and federal government relations at U.S. Bank. “In 2025, the Republicans will have slender majorities in the House of Representatives and the Senate, leaving only a narrow path to the ultimate budget resolution.” In fact, a Republican-drafted funding measure that included extending the debt ceiling for two years failed in a House vote, with dozens of Republicans voting against the measure.

“A small but vocal group of House members sees the budget process as an opportunity to object to further government funding and pursue other aspects of their political agenda,” says MacMillan.

Federal government shutdown precedents

Federal government shutdowns are not a new phenomenon. Since 1980, the federal government has partially shut down on at least 10 different occasions. Between 1980 and 1986, four shutdowns occurred lasting only one day. Three other shutdowns extended just 3-5 days. Since 1995, however, three government shutdowns occurred that lasted much longer.