“The labor market looks set to continue on a positive path,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “We’re not seeing companies let go of many people and job openings continue to outpace the number of unemployed people.” Another recent labor market data point confirms Haworth’s view, as November job openings held steady at 8.1 million, outpacing the number of unemployed Americans seeking work.2

As has frequently been the case, the month’s biggest job gains came in the healthcare industry, adding 46,000 positions, although that numbers was lower than this year’s 57,000 monthly average for new healthcare positions.1 “Healthcare is an area where we’re chronically understaffed,” says Tom Hainlin, senior investment strategist with U.S. Bank Asset Management. “It is an industry with more than one million job openings, so there is more opportunity for continued growth, but employers can’t find enough workers.”

Other major contributors to December’s job gains included retail (+43,000 jobs in December), leisure and hospitality (+43,000 jobs), government employment (+33,000) and social assistance (+23,000).

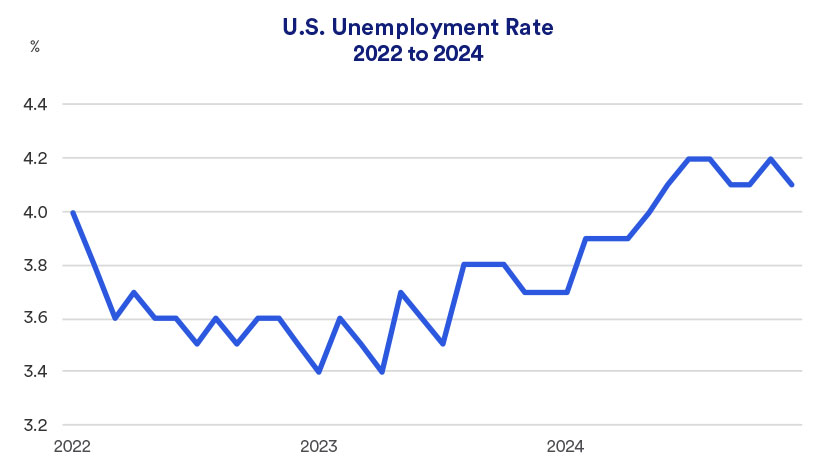

Unemployment remains historically low

Along with improved job growth, the nation’s December unemployment rate ticked slightly lower to 4.1%.1 “When taking a more historical view of the unemployment rate, a number in the low 4% range is quite favorable,” says Haworth.

The unemployment rate stayed below 4% for more than two years, but then in May 2024, it crossed the 4% threshold.3