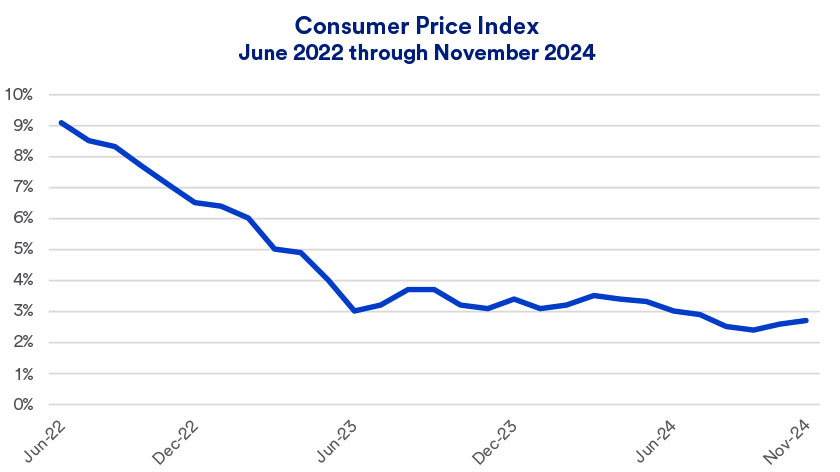

Markets are also closely watching how the new Trump administration's policies could impact the underlying economic environment. As a candidate, President-Elect Donald Trump emphasized plans to expand tariffs on foreign goods imported into the U.S., and the mass deportation of undocumented immigrants. “Tariffs could add to pricing pressures for consumers and businesses,” says Haworth, “and an immigration crackdown could reduce the workforce, possibly driving wages higher.” However, Haworth says markets are still in a wait-and-see mode since no specific policies are yet in place.

Implications for investors

The economy’s ongoing strength helped corporations meet or exceed earnings expectations, fueling further stock market gains. While stocks lost ground on December 18, 2024, when the Fed announced its scaled-back rate cutting plans, the S&P 500 is still on pace for its second consecutive year of 20%+ gains.4

In the current environment, investors may wish to consider a modest overweight of equities and a modest underweight of fixed income, with a neutral position in real assets. Haworth says this reflects an economic environment that, in the near term, appears to put equities in a position to outperform fixed income.

If economic growth tracks closely to the previous two years, Haworth says there may be some market rotation that works to the benefit of stocks that underperformed the broader market. “Attention may turn to where earnings are growing,” says Haworth. “We may see more beneficiaries going beyond those technology companies that generated gains on the artificial intelligence investment boom, which may slow.”

Consider reviewing your current portfolio with your wealth management professional to determine if it’s consistent with your long-term goals and positioned to meet your needs in today’s market and economic environment.

Note: Diversification and asset allocation do not guarantee returns or protect against losses. The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.