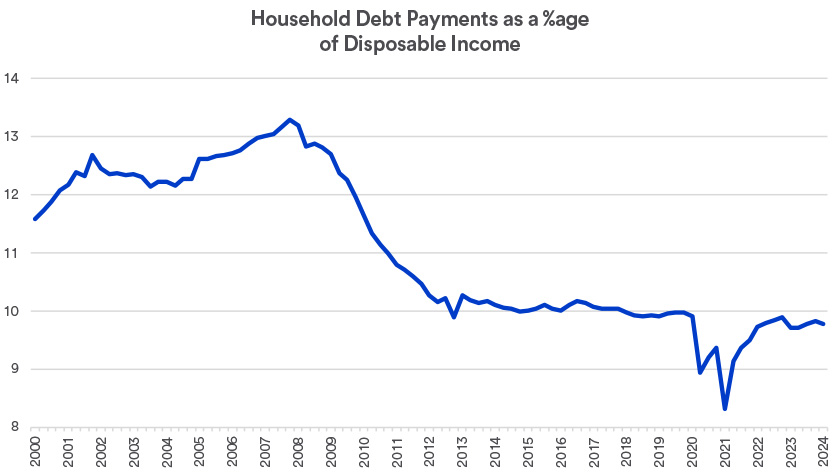

“Following the global financial crisis (from 2007-2009), it appears consumer attitudes and behaviors toward indebtedness have changed,” says Haworth. “Unlike the previous era, consumers today are not so overextended that they will have a hard time paying off debts.”

Manageable consumer debt levels

“Non-mortgage debt is back to pre-pandemic levels relative to income, but not yet anything of concern,” says Matt Schoeppner, senior economist at U.S. Bank. “Mortgage debt is still reasonable by recent standards, even with the spike in mortgage rates.”

The jobs market heavily influences consumer spending habits. “For now, the labor market remains robust,” says Haworth. A key number to watch is the report on initial weekly jobless claims. The measure rose to 265,000 in June 2023, but has been lower since, most recently at 227,000 new jobless claims for the week ending August 10, 2024.8 “It will become more concerning if initial weekly jobless claims consistently rise above 300,000,” says Haworth. “While the unemployment rate has nudged higher in recent months (to 4.3%),9 that’s partly due to the labor force participation rate rising, which is a positive economic development.”

The Federal Reserve (Fed) has indicated it is increasingly focused on labor market strength, along with its emphasis on reducing inflation. With today’s inflation rate, as measured by the Consumer Price Index (CPI), dropping below 3%,9 investors now anticipate the Fed will begin cutting interest rates in September 2024. “We’ll see whether lower interest rates, when they occur, encourage more consumer spending,” says Haworth.

Keeping an eye on debt

What is the risk of consumers spending beyond their means in the coming months? Haworth is watching two key indicators:

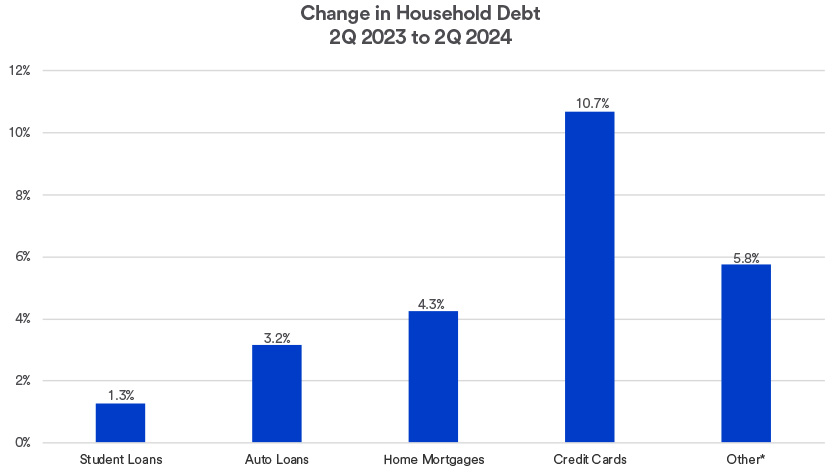

- The volume of revolving credit relative to disposable personal income. This metric remains relatively low based on the most recent data. “If it starts to tick up meaningfully, it could trigger more concerns about the potential for consumers to pull back on spending,” says Haworth. That could contribute to recession fears. However, Haworth believes this risk is receding based on recent data.

- The state of the job market. “If there are signs of weakening employment measures, that could indicate consumers will be forced to rein in spending or carry considerably more debt to maintain current spending levels,” says Haworth. “To date, we’re not seeing recessionary signals like a ramping up of layoffs, and job openings remain high relative to the number of available unemployed workers.”

It’s important to consider the current economic outlook as you evaluate your own portfolio of investments. Talk to your wealth planning professional to assess how your portfolio can be best positioned, keeping in mind current market dynamics and your long-term financial goals.